New Delhi: As connectivity becomes an integral part of vehicle development, it is crucial to understand how it affects the end consumer and thereby balance the benefits of connectivity with the cost it adds to the vehicle.

While connected features offer significant benefits, such as improved safety, convenience, and accessibility, they can also become burdensome for some consumers. The added cost of these technologies can increase the overall price of the vehicle, which may deter potential buyers. For some, the value of these connected features might not justify the higher price tag, making it a key factor in their purchasing decision, according to a recent ‘Think Mobility’ report by Google and Boston Consulting Group (BCG).

The report suggests that in-built navigation is a key feature demanded by two-wheeler consumers in India.

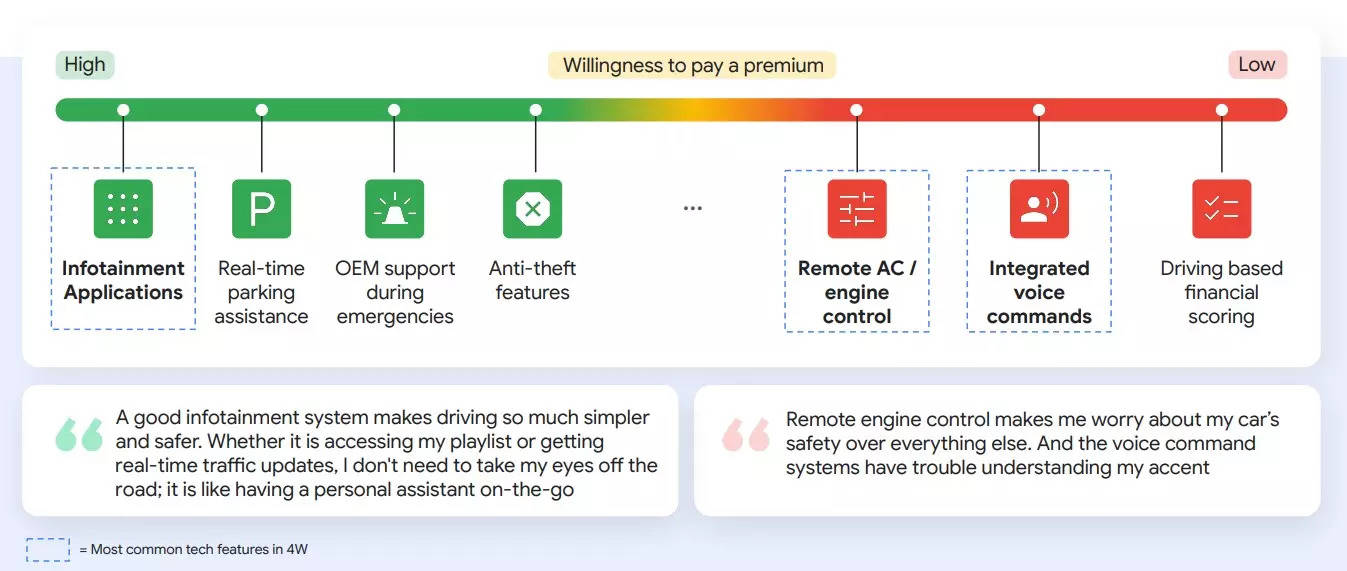

In terms of willingness to pay for a feature, there is strong demand in India– approximately 80%– for features like infotainment, real-time parking assistance, and anti-theft features, while the demand for globally popular connected features such as remote controls remains relatively low, it added.

“As the market evolves, high-tech solutions should be viewed as tools for personal expression, designed to cater to the diverse preferences of different consumer segments,” it said.

Office going, mid-income commuters have high affinity towards advanced tech features like auto-parking assist and real-time information on availability of parking slots. However, high income, status driven commuters look for personalisation features like predictive maintenance tips based on driving behavior.

Mobility industry to double by 2030

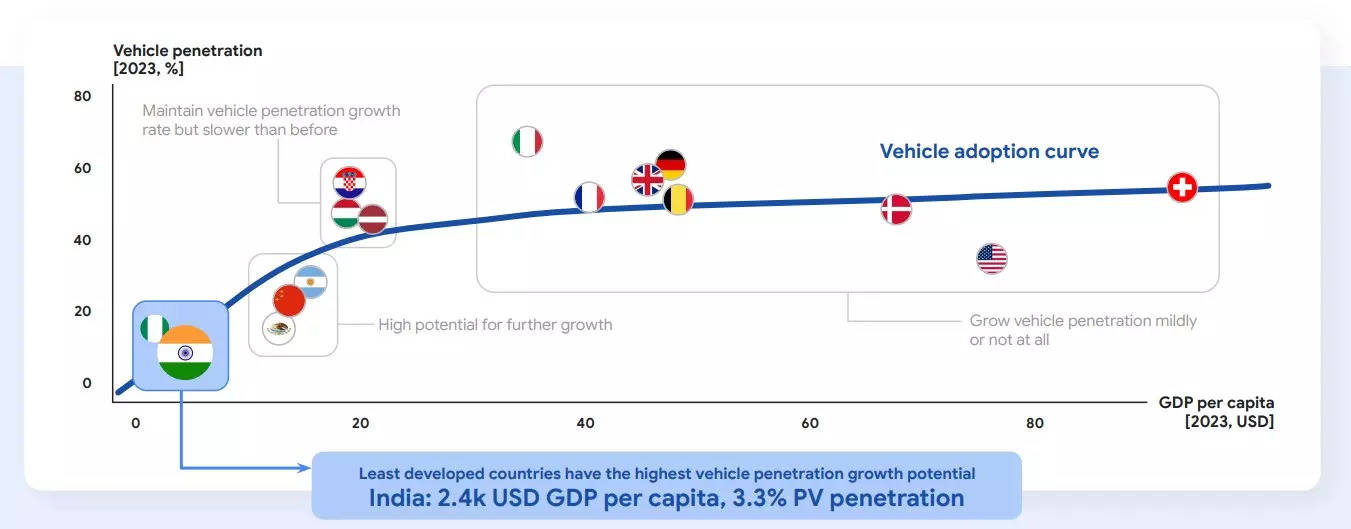

The report has pinned high hopes on India making it attractive as a market for imports and exports, owing to the changing geopolitical scenario. With 3.3% personal car penetration, it sees a huge headroom for growth in the country compared to other regions.

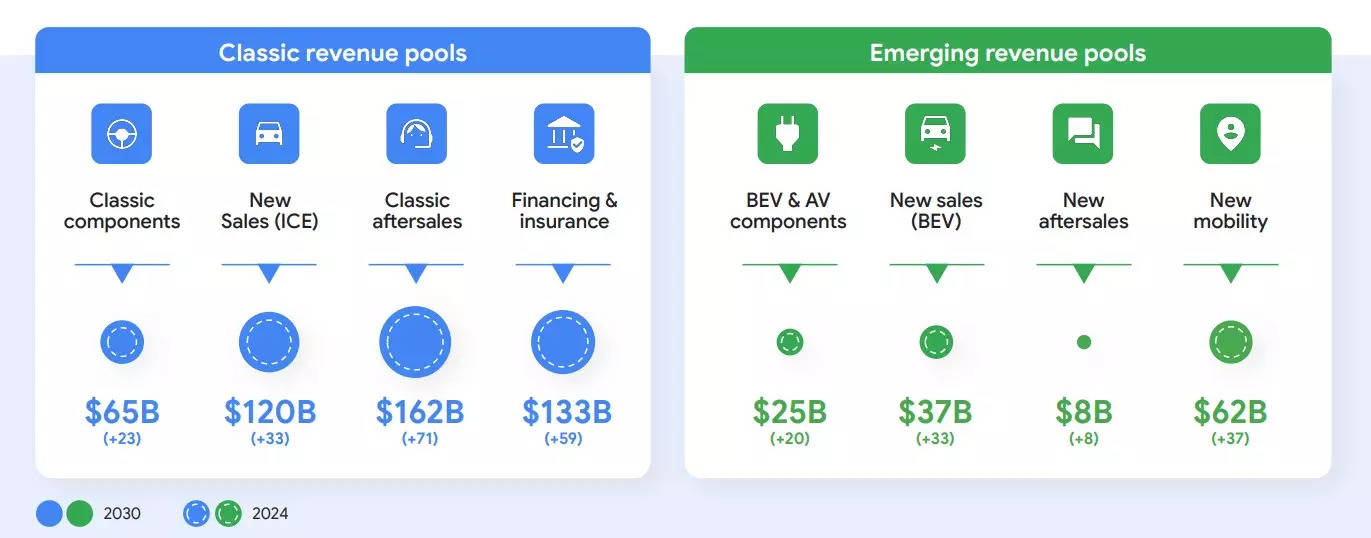

“Industry to double and surpass USD 600 billion by 2030 with about USD 100 billion from emerging revenue pools,” the report said.

The report stated that India is unique in its secular growth across conventional and emerging pools vs global markets where former is eroding against the other. It refers to ICE as classic revenue pools, along with EV and new mobility as emerging revenue pools.