Mumbai: Indian consumers have a high affinity for technology. The smartphone market boom is a good testimony for it. That tech appetite is increasingly seen in the passenger vehicle market too, and it’s not limited to the luxury segment. As predicted, ADAS (Advanced Driver Assistance System) qualified as a leading automotive tech trend of 2024. “On an average, over the last three months, ADAS for us is almost 1/4 of our overall portfolio, and that includes models which we launched much earlier,” Nalinikanth Gollagunta, CEO of Mahindra & Mahindra’s (M&M) Automotive Division told ETAuto. The emerging ADAS tech trend, which is still also a USP for volume models, is expected to see a penetration level of 3% in the 4 million units Indian PV market, according to market research firm Markets and Markets. The adoption level was around 2% in 2023.

Automotive business intelligence firm Jato Dynamics’ granular research shows standard rear parking distance sensor (52%), standard rear parking distance sensor & camera (47%), and auto activation hazard lights (39%) as the top three driving assistance features in terms of their industry penetration rate in India. On the Connected Vehicle tech side, remote services (29%), remote HVAC (16%), and remote start (7%), are listed as the leading ones.

Democratisation of automotive tech

Mahindra & Mahindra, and MG Motor India (now JSW MG Motor India) are the lead players in the volume PV market when it comes to building businesses based on a strategy of democratising technology. The latter, which leveraged the Connected Vehicle and ADAS trends for brand MG’s India market introduction, cites a projection that vehicles with advanced connected features will have an over 55% share by Q1 of 2027. And, vehicles with ADAS tech are expected to have an approximately 10% share.

With these two major trends on the rise, Gaurav Gupta, Chief Growth Officer, JSW MG Motor India, says “I will not be surprised if more than 80 % of customers would like to have a connected car. In fact, by 2030, we expect more than 30% new launches to have some level of ADAS.”

According to Gollagunta, the industry trend of ADAS is proving to be more than democratising technology. “It’s democratising tech in our minds and bringing the volume up. But the second thing is, customers were looking at it as a safety feature (like the 360-degree camera view). The growing consumer awareness, and demand for ADAS has led M&M to ‘democratise’ the tech, by offering it in its compact SUV 3XO, and in all the AX variants of the Thar Roxx.

The XUV700, launched in August ‘21, was the first Mahindra model to offer ADAS, in its top two variants. In the coming year or so, ADAS tech could become standard across all Mahindra models and variants as the solution also becomes more affordable with suppliers leveraging the economy of scale.

2025 will see OEMs pushing the ADAS and connected tech envelopes even further. For example, M&M’s ‘electric origin’ SUVs – BE 6 and XEV 9e, scheduled for launch in February, will have five radars to assist a more advanced tech suite. The OEM’s ICE (Internal Combustion Engine) models with ADAS tech have one each.

The new ‘battlefield’

It’s not only ADAS and Connected Vehicle tech that vehicles will rely on to woo customers in 2025. Display technology will also flex its muscle with different offerings to the driver, and other occupants in the vehicle. It’s already beginning to happen. “The next battlefield in some form or shape, and it’s already happening right now, is the amount of screen real estate which is there in each car,” says Gollagunta.

Like luxury cars, volume PV models will increasingly have more screens in the instrument panel/dashboard, and also offer screens for rear seat occupants. Global display technology major Visteon’s CEO Sachin Lawande says, “Every car will have at least one large display, more likely two, if not more.” For example, the upcoming Mahindra EVs will come with three screens, in their pillar-to-pillar display unit. Another two can be for the rear passengers.

This growing trend of advanced display technology also makes Visteon see India as a 10 million unit automotive display market of display sizes 10 inches and higher, by the end of this decade.

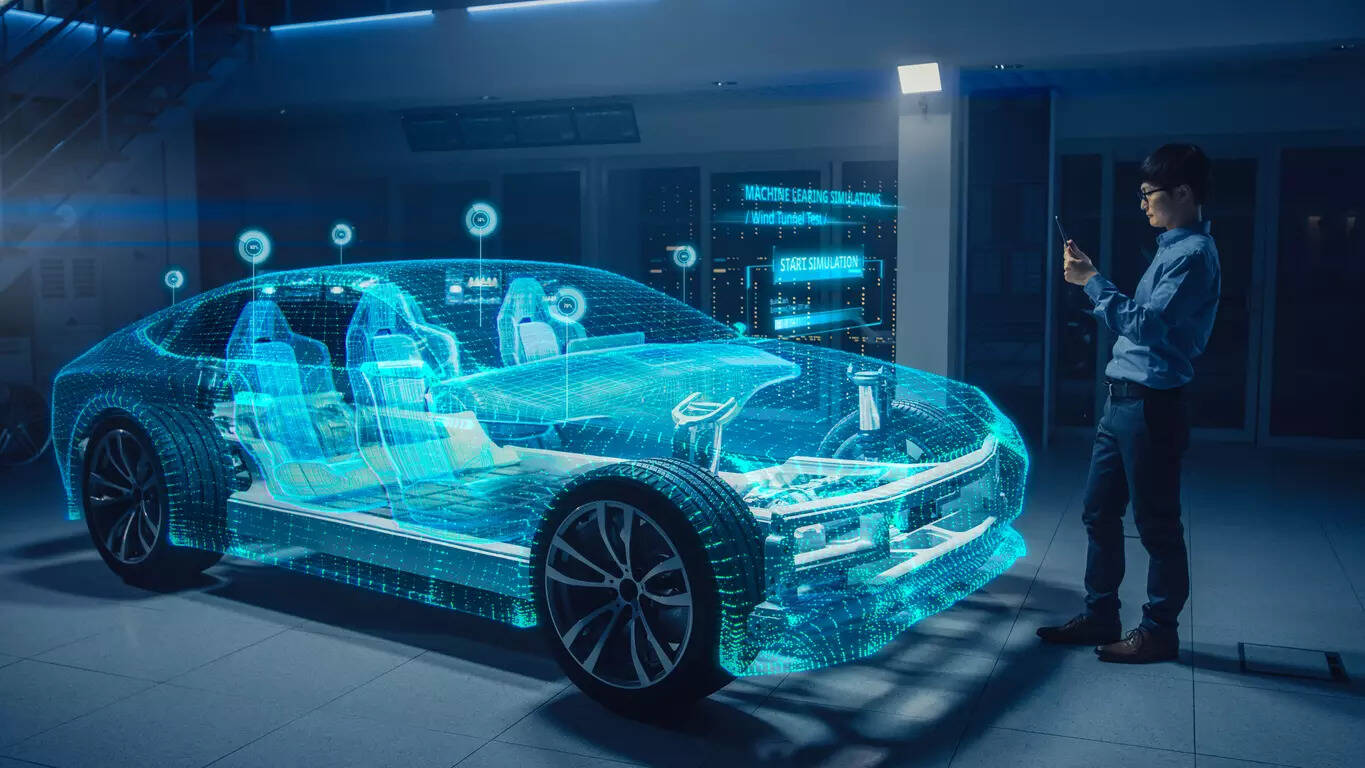

AI enters the vehicle

The growing global AI wave is also set to influence the in-car experience now. In the battle for customers’ attention and interest, Generative AI (Artificial Intelligence) will see major usage by OEMs in 2025. Especially to enhance the user experience. As Lawande puts it, “AI is the new UI”. The software driven technology can be almost revolutionary. “Think about everything that you are currently doing with the system in the car, enhanced through AI,” says the global industry leader.

After Connected Vehicle tech, which is getting enhanced with 5G connectivity, and ADAS, Gollagunta counts AI as the third dimension of new automotive trends, which will also see major gains in 2025. “Vehicles will start to have a lot more augmented reality and AI capabilities built in,” he says, and cites the example of heads-up display (HUD) with augmented reality in the Mahindra BE 6. AI for cameras in the vehicle, for facial recognition, driver drowsiness etc. will also see adoption in volume passenger vehicle models.

Battling the cost challenge

As much as there the Indian market may offer great opportunity, thanks to its hunger for new technology, industry players will have to also meet the additional cost challenge that new technology usually comes with.

“Next year is going to be a year of consolidation, meaning that the inflation that has happened in costs, in getting here, whether it is battery costs, electronics cost, displays costs, we need to be able to drive strategies to make this cost become more affordable, so that the promise of the growth that we are all expecting can actually be delivered,” says Lawande.

To ride the India opportunity better, and also leverage the country’s competitive production costs, Visteon looks to strike a collaboration or two with partners here for local production of its display products.

Collaboration as a business growth or technology development strategy will see more traction in 2025. According to Raghavendra Vaidya, MD and CEO, Daimler Trucks Innovation Center, Daimler Truck’s GCC (Global Capability Center) in India, collaboration across industries is set to be a major force driving India’s automotive evolution, with strategic partnerships accelerating advancements in EV infrastructure, autonomous driving, and next-generation mobility solutions.

He also adds that a significant emerging trend is the willingness of leading automotive companies to advance the development of cutting-edge software platforms, enhance vehicle connectivity, and build an integrated digital ecosystem.

The SDV charge

All the advanced automotive technology features that are beginning to emerge, and more to come in 2025 and beyond, will be enabled only by the software defined vehicle (SDV). This trend will also help OEMs to be more cost effective, while also helping democratise technology as multiple features can be based on the same software platform/architecture.

If consumers lap up more software defined vehicles, the better it would be for both the buyers and vehicle manufacturers. “The more volume you get, you actually get more competitive and therefore technology democratisation, while it’s good for customers, it’s also good for us,” says Gollagunta.

Lawande lists softwarisation, along with digitalisation, and electrification also as key trends to watch out for in 2025.

With all the fares lined up for 2025, some already showcased, and more to come up in the international mela of Bharat Mobility Expo, scheduled for the third week of January, industry players would be hoping for a good drive in the coming year.